Your credit score is one of the most important, if not the most important, numbers in both your personal and professional life. It often determines if you will get a certain job, whether you will qualify for a rental apartment or house and whether you can obtain a loan for a home, a car, or for any other purpose and on what terms. Prospective employers will look at it in deciding whether or not to offer you a job, prospective landlords will pull your credit before agreeing to rent a home or apartment to you and any prospective lender will always pull your credit before agreeing to extend any kind of loan or financing to you.

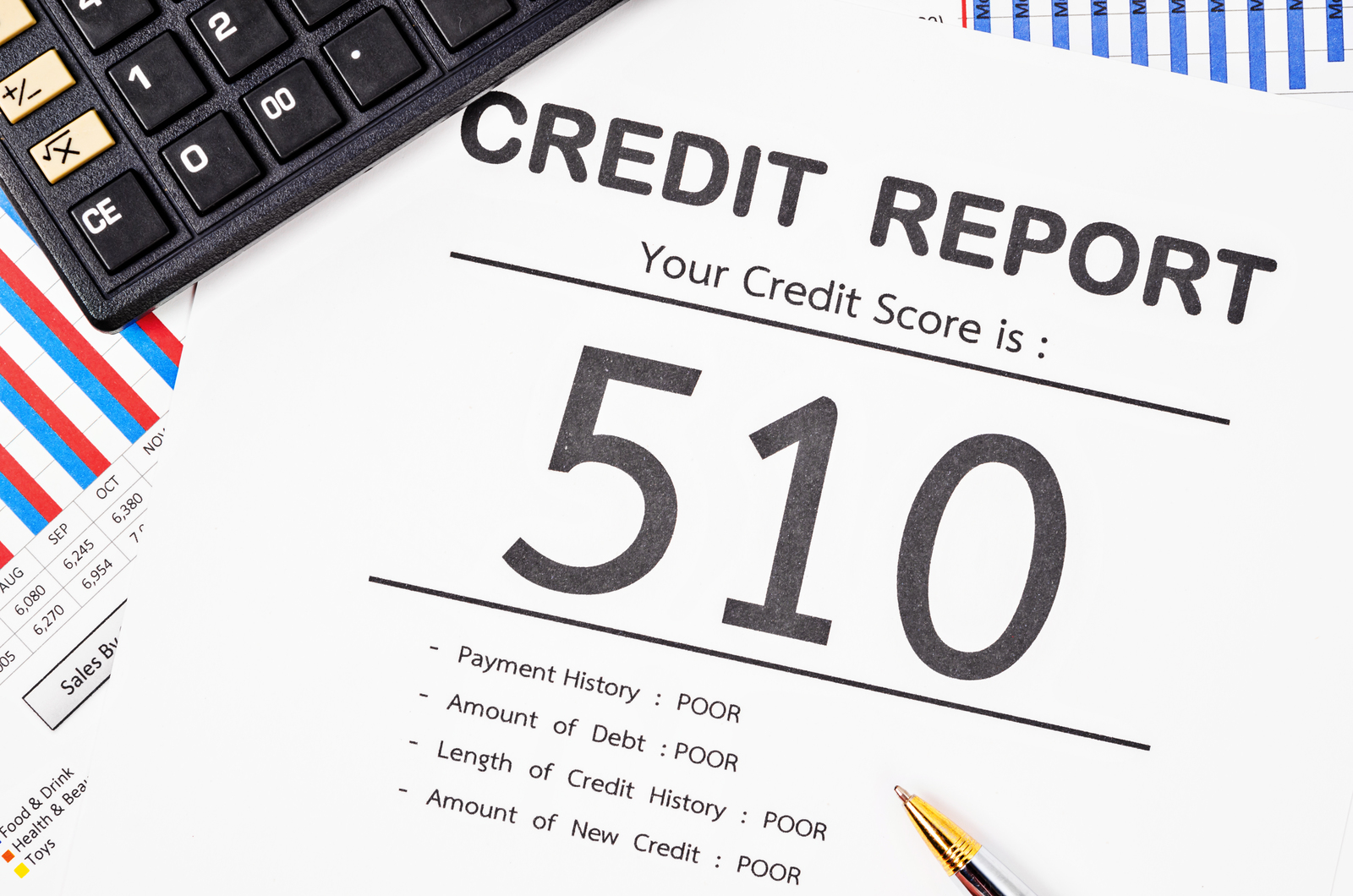

Nevertheless, how a credit score is calculated is a mystery to most consumers. However, the formula that is most often used to calculate credit score, the Fair Isaac or FICO for short, consists of five primary factors, each of which is weighted differently in the final calculation of a particular individual’s credit score and each of which is individually discussed in detail below.

1. Your Payment History: 35%

Your payment history is often considered to be the most important component of your credit score given it shows your track record of repaying past loans or financing you have received. This component of your score considers some the following factors:

- Did you pay your bills on time? If you were late, how late were you in paying? Do you have a regular pattern of paying your bills late?

- Someone who missed one payment or made one payment late is typically viewed more positively than someone who makes it a habit to always make late payments on every single bill every single billing cycle

- Have you ever been sent to collections? How about any bankruptcies, foreclosures, wage garnishments, or judgments against you, are there any of these in the past?

- Most of these are matters of public record, so it is easy to verify them from the lender’s perspective

2. Credit utilization ratio: 30%

Your credit utilization ratio considers how much credit you have available to you and what percentage of that credit you are using at any one time. However, having a 0% credit usage rate is not necessarily ideal, as potential lenders want to see a steady track record of repayment, even if it is just a $9.99 recurring charge for your Netflix subscription. Having less credit outstanding is generally positive, but not using any of the credit available to you means lenders cannot see you have a track record of managing that credit responsibly and paying it back on time.

3. Length of Your Credit History: 15%

Your credit score also takes into account how long you have been utilizing credit. Factors taken into account in determining this portion of your credit score are the average length of all the accounts on your credit report and the age of your oldest account. Having a lengthy credit history is good for your credit score, particularly if your credit report is not littered by late payments or other black eyes, because it indicates to lenders that you have a successful track record of paying back your credit. Nevertheless, a short credit history is not necessarily harmful, as long as you have made your required payments on time.

4. New Credit: 10%

Your FICO score also considers how many new accounts you have on your credit report. It looks at how many new accounts you have applied for and opened in the recent past and when the last time you opened a new credit account was. Whenever a lender is looking at your credit report, he or she does either a soft or hard inquiry to check your credit. A hard inquiry is when you apply for a new source of credit and submit a formal application. A soft inquiry takes place when a potential employer pulls your score, you pull your own score, etc. Having too many hard inquiries on your credit report is a negative sign and can cause your score to drop because it is seen as you potentially having problems paying back your existing debts, so you may be looking for a short-term fix that may just kick the can down the road rather than being any sort of real solution.

5. Types of Credit in Use: 10%

The final aspect FICO’s formula considers in determining your credit score is what types of credit are present on your report. This looks at whether you have credit cards, a mortgage, a car loan, etc. Lenders like to see a variety of different types of credit and that you have a history of successfully paying back each one.

Leave A Comment